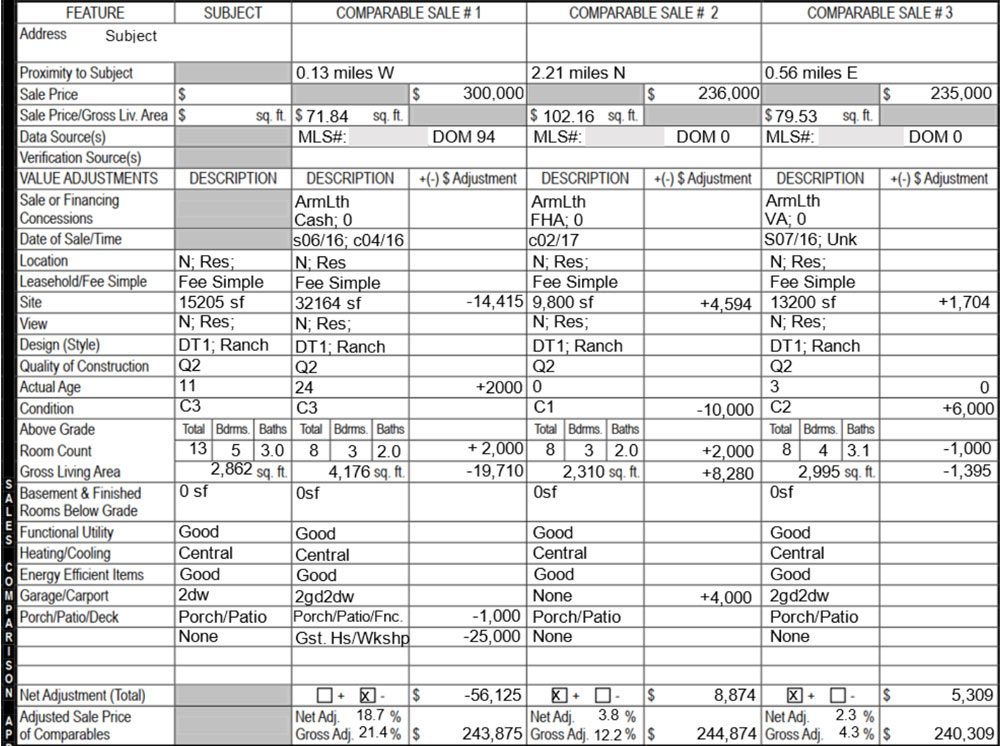

The process of determining a property’s market value is called a real estate appraisal. The person who appraises the property, the appraiser, physically inspects the property to measure it, take pictures of it, and make note of the condition and the quality of the construction.

The appraiser also needs to be aware of the zoning regulations, city ordinances, and other restrictions that can affect the value of the property. He may also need to know about any recent changes in the neighborhood, such as new constructions, new roads, and new amenities, as well as any special features that can affect the property value. Finally, the appraiser needs to consider the economic conditions, such as supply and demand, population density, demographics, economic trends, and the job market.

After the appraiser completes all the necessary research, he writes a report to present his opinion of the market value of the property. The report must be detailed and include all the information needed to support his opinion. The appraiser must also provide an explanation of how he arrived at the value, as well as any assumptions and adjustments made. The report must be signed and dated by the appraiser in order to be used by the client.

This is of course how a typical appraisal report is generated. Oftentimes, appraisers face situations where a physical inspection alone may not provide all the relevant data required. In the case of a new construction property, the appraiser may only be able to inspect a vacant plot of land; the proposed house is still not built. Or, the appraiser may not have been granted access to the interior of a house such as in the case of exterior appraisals. In cases like this, the appraiser has to make assumptions about information that cannot be physically verified or collected firsthand.

Whenever an appraiser determines that making an assumption is necessary, he typically makes one of two types of assumptions. The types are either Extraordinary Assumptions or Hypothetical Assumptions. This article will explain what these two are and the situations in which an appraiser might employ them.

Extraordinary Assumption:

USPAP defines an Extraordinary Assumption as a presumption that, if proven to be wrong, could change the appraiser’s judgments or findings. It is directly related to a specific assignment as of the effective date of the assignment results. What does this mean?

It means that the appraiser is dealing with uncertain information and is assuming something to be true. The information that the appraiser is uncertain about could be about the physical, legal, or economic characteristics of the subject property. Or, more generally, it could be about things external to the property, such as market conditions or trends; or about the integrity of the data used in an analysis.

A simple, common example would be when an appraiser is not able to complete a full physical inspection. An appraiser may discover that one unit in a multifamily property is locked and inaccessible. While they inspected the other units and have firsthand information about them, such as the number of bedrooms, bathrooms, the condition and quality of the interior, etc.; the appraiser doesn’t know what this locked unit contains or what condition it might be in.

In situations like this, the appraiser makes an Extraordinary Assumption. The appraiser assumes this locked unit matches the public record information, that it has the reported number of rooms, and is in line with the reported quality and condition. He further assumes the locked unit is in conformity with the rest of the subject and matches with what the appraiser was able to inspect. This assumption is specific and tied directly to the subject property and is made as of the effective date of the appraisal.

Hypothetical Assumption:

USPAP defines a Hypothetical Assumption as a condition, that is directly related to a specific assignment, and which is contrary to what is known by the appraiser to exist on the effective date of the assignment results but has been used for the purpose of analysis. What does this mean?

It means that the appraiser is making an assumption that is contrary to known facts; in other words – the appraiser is making an assumption about the subject that is not actually true. The assumption might be about physical, legal, or economic characteristics of the subject property; or about conditions external to the property, such as market conditions or trends; or about the integrity of data used in an analysis.

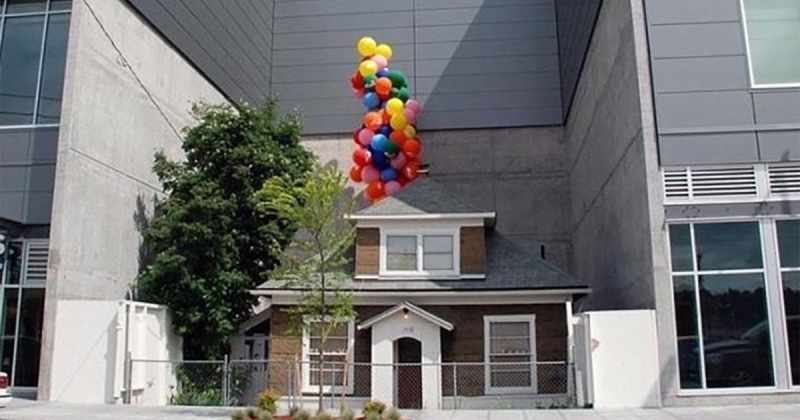

A simple, common example would be when an appraiser completes a report on a proposed, new construction property. The appraiser does his work based on architectural plans and construction specifications, all providing details about a subject property that is yet to be built.

At the time of the appraisal report and on the effective date, the subject property might just be vacant land. However, for the purpose of analysis and in order to actually produce the report; the appraiser assumes that the property is already complete. He or She further assumes that this hypothetical property conforms with the plans and the specifications provided.

Required Disclosures:

Whenever an appraiser makes a Hypothetical Assumption or an Extraordinary Assumption, there are requirements that these assumptions be made with proper disclosures.

Extraordinary Assumptions must be clearly disclosed in the appraisal report, and the report must notify intended users that the extraordinary assumptions might have affected the assignment results. The appraiser need not report on the impact of this assignment condition—only that it might have affected the assignment results. Though an extraordinary assumption might be employed in an assignment, there is no USPAP requirement that it be labeled as such.

Hypothetical Assumptions must be clearly disclosed in the appraisal report, and the report must notify intended users that the hypothetical conditions might have affected the assignment results. Again, the appraiser need not report on the impact of this assignment condition—only that it might have affected the assignment results. Additionally, a Hypothetical Condition might be encountered in an assignment, there is no USPAP requirement that it be labeled as such.

An appraisal is not inherently flawed because it is premised on a hypothetical assumption. An appraisal is not erroneous because it is premised on an extraordinary assumption. In some cases, it may be impossible to provide a value that is not premised on an assumption.

Assumptions and hypothetical conditions are established at the beginning of the valuation process and the valuation proceeds from that basis. The use of assumptions, whether extraordinary or hypothetical, may affect the Scope of Work for an appraisal. The Scope of Work in turn affects how the valuation or review process is carried out, and that in turn can affect the assignment results (e.g., the value opinion in an appraisal). In all cases, the use of an assumption or a hypothetical condition must result in a credible opinion or conclusion, given the intended use.